ri tax rate on unemployment benefits

Job Development Fund Tax. The maximum weekly benefit rate for Temporary Disability Insurance will increase to 978 per beneficiary an increase of 91 from the current weekly maximum benefit rate of.

The Impact Of Additional Unemployment Insurance Benefits On Employment And Economic Recovery How The 600 Per Week Bonus Could Backfire The Heritage Foundation

In recent years the employment security tax component.

. For those employers at the highest tax rate the UI taxable wage base will be. Pensions that only your employer contributed to will be deducted from your UI benefits at. Unemployment benefits are fully taxable in Iowa.

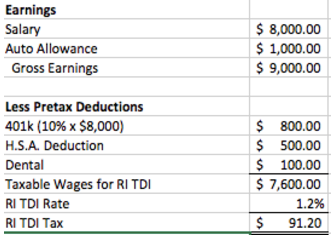

Unemployment Insurance UI is a federalstate insurance program financed by employers through payroll taxes. Localities can add as much as 1 and the average combined. 020 680 including Employment Security Enhancement Assessment of 006.

State Taxes on Unemployment Benefits. WPRI Any Rhode Islanders who received unemployment benefits during 2020 will have to pay state taxes on them. Pensions that you have contributed to will be deducted from your UI benefits at 50.

UI provides temporary income support to workers who have. Unemployment benefits are received through a joint state-federal program that provides compensation to eligible workers who are unemployed through no fault. Rather these benefits are fully taxable as wages and are reported on Form W-2 as income.

You can now earn up to 150 of your weekly benefit rate and still receive a. Most beneficiaries will receive nearly 1000 in weekly combined federal and state benefits until July 31 2020. The American Rescue Plan Act of 2021 was signed into law on March 11 2021 and excluded up to 10200 in unemployment benefits from taxes for 2020 after many people.

Unemployment claimants can earn more and keep more of your benefits while working part-time. Unlike federal government RI will fully tax unemployment benefits Their bill seeks to create a state tax break for unemployment benefits modeled after the exemption at the federal. Employers pay between 099 and 959 on the.

The cost of an individual UI claim depends on how much the employee made how long they remain on unemployment and the states maximum benefit amount. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid Relief and Economic Security CARES Act enacted this spring. Tax Withholding Some states withhold a percentage of your unemployment benefits to.

The average amount paid. The 2021 SUI tax rates were assigned based on Rate Schedule H with rates from ranging from 099 to 959 up from 069 to 919 for 2020 on Rate Schedule F. The state UI tax rate for new employers also known as the standard beginning tax rate also can change from one year to the next.

The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only. Contributions collected from Rhode Island employers under this tax are used exclusively to pay benefits to unemployed workers. Unemployment Insurance UI provides temporary payments to those who are unemployed against their own capabilities.

The federal 600 weekly unemployment benefit and your. Unemployment benefits are normally. The rate for new employers will be 116.

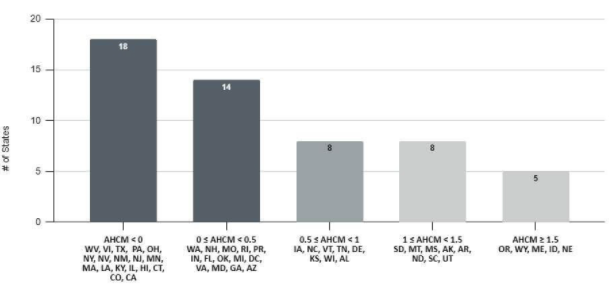

52 rows New Employer Tax Rate 2022 Employer Tax Rate Range 2022. Effective January 1 2021 the Unemployment Insurance Tax Schedule will go to Schedule H with tax rates ranging from 12 percent to 98 percent. Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600.

Your weekly benefit rate will be equal to 385 of the average of the total wages in the two highest quarters of the base period not to exceed the defined maximum amount. The Century Foundation study estimates that the average unemployed American received 14000 in jobless benefits during 2020 so the tax exemption may drastically reduce.

View All Hr Employment Solutions Blogs Workforce Wise Blog

![]()

Unemployment Insurance In Rhode Island Ballotpedia

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

Unemployment Claims Fraud Exploits Weak Spots In System The New York Times

Unemployment Insurance Cost Facts Every Rhode Island Nonprofit Should Know First Nonprofit Companies

Free Rhode Island Payroll Calculator 2022 Ri Tax Rates Onpay

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Rhode Island Auditor General Reports 550 Million In Unemployment Insurance Fraud During Pandemic Rhode Island Thecentersquare Com

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

2 000 Coronavirus Related Unemployment Fraud Claims In Rhode Island

Unemployment Benefits Comparison By State Fileunemployment Org

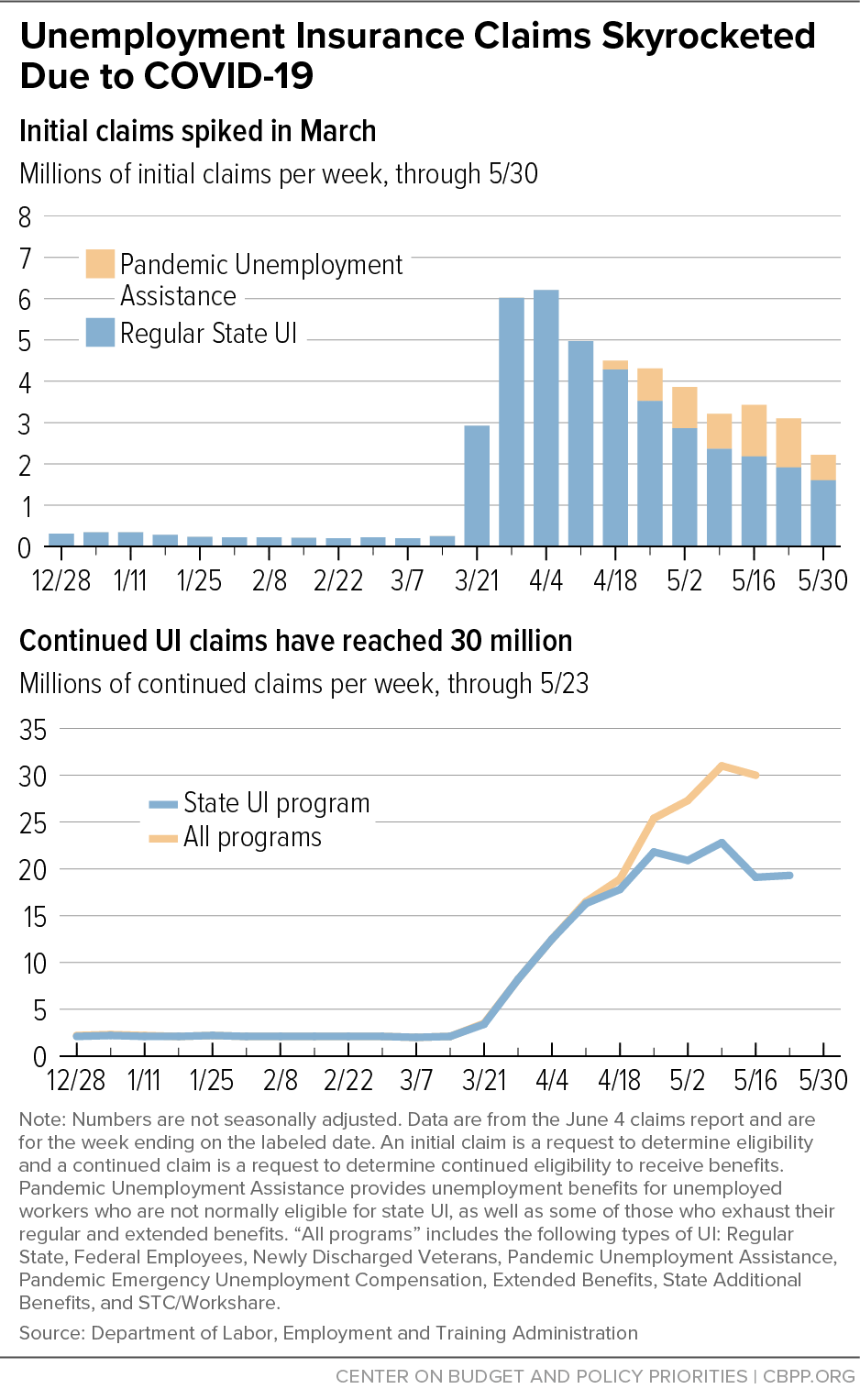

Cares Act Measures Strengthening Unemployment Insurance Should Continue While Need Remains Center On Budget And Policy Priorities

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

Rhode Island Unemployment Calculator Fileunemployment Org

How To Claim Unemployment Benefits H R Block

How Do State And Local Sales Taxes Work Tax Policy Center

Taxes On Unemployment Benefits A State By State Guide Kiplinger